Billund, Syddanmark, Denmark-based Billund Aquaculture, a specialist in the design and installation of recirculating aquaculture systems, plans to declare bankruptcy.

The Covid-19 pandemic and economic fallout from sanctions imposed following Russia’s invasion of Ukraine exacerbated the company’s financial troubles, according to Billund Chairman Jon Refsnes.

“The company deeply regrets having to take the decision but that, unfortunately, there are no other options,” Refsnes said in a press release.

Billund has not published its 2023 financial report, but in 2022, it lost DKK 97.3 million (USD 14.1 million, EUR 13 million), marking its fourth consecutive annual loss. In 2021, it reported a loss of DKK 1.5 million (USD 218,000, EUR 201,000), while in 2020 it lost DKK 18.7 million (USD 2.7 million, EUR 2.5 million) and in 2019 it lost DKK 14.6 million (USD 2.1 million, EUR 2 million). It posted a profit of DKK 8 million (USD 1.2 million, EUR 1.1 million) in 2018.

The company’s revenue had hovered between DKK 408 million (USD 59.2 million, EUR 54.7 million) and DKK 515 million (USD 74.7 million, EUR 69 million) in those years, but in 2022, it sank to DKK 268.7 million (USD 39 million, EUR 36 million). Its equity dropped from DKK 115.9 million (USD 16.9 million, EUR 15.5 million) in 2021 to DKK 39.1 million (USD 5.7 million, EUR 5.2 million) in 2022, and it predicted a loss of DKK 3 million (USD 436,000, EUR 402,000) to DKK 7 million (USD 1 million, EUR 938,000) in 2023.

“The main contributor to the negative 2022 result has been significant reductions from the expected to the realized contributions margin on a number of projects being finalized during 2022. These are projects that were entered into prior to Covid-19 and the war in Ukraine, and which significantly was impacted by external factors such as Covid-19, inflation, and high volatility in project cost input,” it said. “The group has experienced a lower-than-expected turnover, as several projects in 2022 were postponed as a consequence of significant macro uncertainties, especially relating to high inflation and extensive volatility in cost input to the industry.”

Previously owned by Broodstock Capital, the company was sold in 2022 to Havbruksparken Utvikling, Stoksund, and the Sørensen family. Ownership includes the Refsnes family, which owns Columbi Salmon and part of the salmon producer Refsnes Laks; the Lofsnæs family, which owns the salmon producer Bjørøya; and the Rasmussen family, which has investments in real estate and the software industry.

Broodstock retained a 75 percent stake in Billund Aquaculture Norway, which was split off from Billund Aquaculture and subsequently renamed VAQ. VAQ will not be impacted by Billund’s planned bankruptcy.

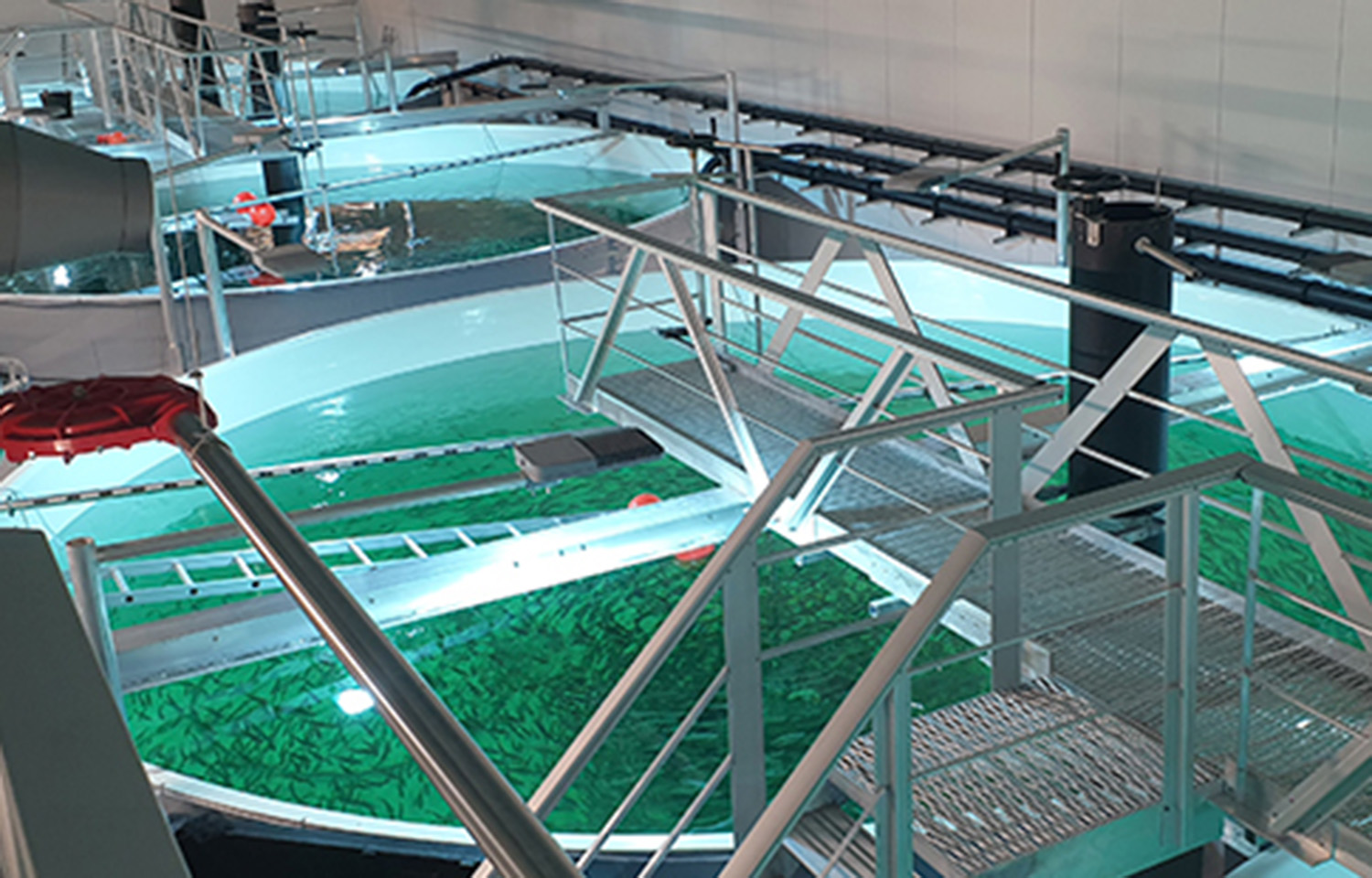

Billund Aquaculture has installed more than 130 plants in over 20 countries, and more recently projects it has been involved in include a striped bass RAS for Pacifico Aquaculture, a joint venture shrimp RAS with Aquapurna, and numerous salmon hatcheries in Norway, Chile, Australia, and the U.K. It was removed from its work on Atlantic Sapphire's Bluehouse salmon farm in Miami, Florida, U.S.A., after Atlantic Sapphire deemed it responsible for problems that led to a mass mortality incident, as well as other biological issues. It has 250 employees and offices in Denmark, Chile, Norway, Australia, and the U.S.

Billund CEO Kristoffer Lund said his firm had positive results in 2023, but could not overcome financial issues he blamed on the company’s previous ownership. Lund was hired as CEO in April 2024, and is a specialist in organizational transformation.

“Unfortunately, there have been too many challenges from previous operations, which made it difficult to find sufficient capital for further operation. Despite good operational progress, the company’s efforts to secure its capital needs were ultimately hampered by disputes from before the 2022 changes,” Lund said in a press release, according to Kyst.no. “Based on this, the board has concluded that there is no basis for further operation. Efforts will now be made to find the best possible solutions for all our employees, customers, and creditors.”