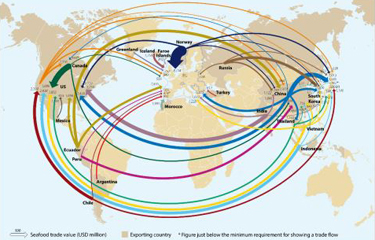

Soaring demand for fishery and aquaculture products has positioned seafood as the most globally traded animal protein, with a trade value of USD 164 billion (EUR 155.8 billion) in 2021, increasing by a compound annual growth rate (CAGR) of more than 2.4 percent in the 10-year period 2011-2021, according to the latest seafood trade map and report compiled by Rabobank.

The “2021 World Seafood Map” found that close to half of last year’s trade flowed to the European Union, the United States, and China, whose combined imports surpassed USD 80 billion (EUR 76 billion). According to the analysis, the seafood trade was roughly 3.6 times the size of beef trade (the second most traded animal protein) in 2021, five times the size of the global pork trade, and eight times that of the poultry trade. It also confirmed that there were more than 55 trade flows each valued over USD 400 million (EUR 380 million) a year, and an additional 19 trade flows valued between USD 200 million and USD 400 million (EUR 190 million and EUR 380 million) each.

“Developing countries play a major role in seafood exports, accounting for seven of the top 10 exporters, and developed countries are increasingly reliant on developing nations for imports of high-value species, especially shrimp from India and Ecuador and salmonids from Chile,” said Rabobank Seafood Analyst Novel Sharma, who co-authored the map with Rabobank Senior Seafood Analyst Gorjan Nikolik.

Rabobank said seafood trade from Norway to the E.U.-27 plus the United Kingdom continued to be the most-valuable industry trade-flow, valued at over USD 8.7 billion (EUR 8.3 billion) and largely comprised of farmed salmon. In second place was the trade from Canada to the United States, valued at USD 5 billion (EUR 4.8 billion) and dominated by crustaceans (excluding shrimp), valued at USD 3.34 billion (EUR 3.2 billion). Following closely behind with USD 3.3 billion (EUR 3.1 billion) worth of seafood trade were exports from India to the United States, driven mainly by the sale of farmed vannamei shrimp, which made up 80 percent of Indian seafood exports to the U.S. market.

Rabobank said the E.U.-27 plus the United Kingdom remains the world’s largest seafood market by value, importing products worth over USD 34 billion (EUR 32.2 billion) last year. Since 2013, the value of this market has grown at a CAGR of 2 percent.

U.S. seafood imports totaled USD 28.1 billion (EUR 26.7 billion) in 2021, which was USD 8.6 billion (EUR 8.2 billion) more than in 2016, while the CAGR has grown at 6 percent. Imports were led by shrimp, salmonids, crab, and lobster, which accounted for 91 percent of the total value added.

China’s seafood imports were valued at USD 17.2 billion (EUR 16.3 billion), according to Rabobank. From 2013 to 2021, China’s seafood-import volumes experienced a CAGR of 4.4 percent, while its import value had a CAGR of 10.1 percent revealing a demand shift to more-expensive forms of seafood.

Beyond China, there is a global trend favoring higher-value seafood, according to the Rabobank study, which found the COVID-19 pandemic further strengthened already high demand for species such as shrimp and salmonids. This trend is further evidenced by the strong rebound in imports in 2021 that followed initial COVID-19 lockdowns, Rabobank said, with the growth driven by demand for shrimp, fishmeal, crab, and salmonids, all of which exhibited double-digit year-on-year growth. Together the growth in demand for the species accounted for 94 percent of the global growth in seafood imports by value, which cumulatively rose USD 2.4 billion (EUR 2.3 billion) compared to 2020, the report found.

“During the pandemic, we saw higher-value proteins such as beef, shrimp, and salmonids outperform other proteins, with year-on-year growth in trade value of 16 percent, 17 percent, and 20 percent, respectively,” Nikolik said. “We are also seeing unprecedented high prices for many seafood species due to challenges in international trade such as rising freight and energy costs and continued lockdowns in China.”

However, Nikolik said that recent data suggests the impact on seafood demand may become material, especially if a recessionary environment develops in the second half of 2022 or 2023.

“This could affect seafood market prices and the value of trade flows,” he said.

Both Sharma and Nikolik said they expected demand for sustainable and healthy seafood to continue driving trade volumes of high-value species in the next few years.

Image courtesy of Rabobank