Despite mounting concerns over rising costs and general market conditions, there’s optimism across the aquaculture industry coming into the New Year, according to new analysis compiled by the RaboResearch unit of Rabobank.

Summarizing key takeaways from the Global Seafood Alliance’s (GSA) GOAL Conference 2022, held in Seattle, Washington, U.S.A. in October 2022, Rabobank’s latest aquaculture report, “What to Expect in the Aquaculture Industry in 2023,” found the global shrimp supply is on a positive trajectory, while farmed salmon production should “normalize in the short-term.”

Compiled by Rabobank Seafood and Aquaculture Analyst Novel Sharma and Rabobank Senior Global Seafood Specialist Gorjan Nikolik, the report forecasts global shrimp production could reach 6 million metric tons (MT) in 2023. Ecuadorian shrimp production is set to grow between 18 and 30 percent in 2023. In 2022, Ecuador produced an estimated 1.35 million MT of shrimp, its largest single-year volume growth, adding 300,000 MT to its supply. This growth alone is only slightly lower than Thailand’s total annual production and will lift production in the Americas beyond 2 million MT, according to Rabobank.

Elsewhere in 2022, Asia – the largest shrimp-producing region – was expected to experience its first volume decline since 2013, albeit just a 0.1 percent drop. However, this decline will be temporary and the region’s output will rebound in 2023 thanks to higher production in China and India, and a slight increase in Vietnam’s output, Rabobank found. Collectively, this should push Asian production above 4 million MT in 2023.

Overall global shrimp supply increased by 4.2 percent in 2022 and Rabobank remains positive about 2023, with Ecuador’s supply growth accompanied by a “strong” 9.5 percent recovery in Chinese production, Sharma said.

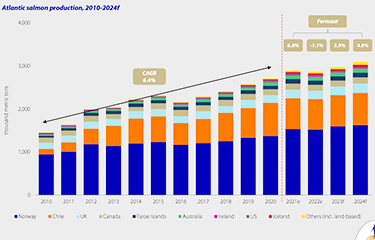

In the Atlantic salmon-farming sector, after a volatile 2021 that saw Norway expand its year-on-year supply by 11.9 percent and Chile’s harvest contract by 7.7 percent, Rabobank expects 2022 to have delivered the first overall salmon production decline since 2016.

Supplies from Norway and Chile are expected to have fallen by 0.9 percent and 0.3 percent, respectively in 2022, followed by a “normalization of growth” from 2023 to 2024, as both countries use regulatory controls to moderate supply growth, he said.

Sharma predicted global salmon production will increase by an estimated 4 percent in both 2023 and 2024, nearing 3 million MT in 2023 and then surpassing that total in 2024. Cumulative supply growth for Norway and Chile between 2022 to 2024 is expected to drop to 3.1 percent, compared with the previous decade’s 7 percent compound annual growth rate (CAGR).

The lower growth expectations for Norway and Chile create an opportunity for Iceland and the Faroe Islands to become more relevant drivers in the global supply this decade, Sharma suggested. Salmon production in the Faroe Islands increased 31 percent in 2021, but its harvests fell 4 percent in 2022 and will likely fall a further 1 percent in 2023. However, Rabobank predicted a 10 percent increase in Faroese Atlantic salmon for 2024, taking the Faroes to record levels of production.

Separately, Iceland’s Atlantic salmon production rose 44 percent in 2021, which made it the fastest-growing producer in percentage terms. Rabobank projects Iceland’s Atlantic salmon production climbed 7.8 percent in 2022 and will rise 6.2 percent in 2023, amounting to 51,000 MT of Atlantic salmon.

Rabobank’s report found diverging trends are evident for tilapia and pangasius production. Latin America is leading the growth in tilapia production, although the region’s volumes are “still small” compared to China, Egypt, and Indonesia. Rabobank anticipates year-on-year increases in tilapia production of 4.3 percent in 2022 and 4.8 percent in 2023 in Latin America, reaching 6.8 million MT of volume by the end of the year.

The global pangasius supply has “stumbled” due to a slowdown in production from top producer Vietnam in recent years, according to the report. Although Vietnam’s production climbed an estimated 3.1 percent in 2022, taking the global supply up to 2.8 million MT, the total remains below the 3 million MT record set in 2019.

The analysis found while market prices were the key concern for fish farmers in 2021, the volatility seen in markets for feed ingredients – coinciding with the start of the war in Ukraine – has become the top concern for aquaculture business operators coming into 2023.

Feed prices will remain elevated in 2023, according to Sharma, and the industry faces additional issues concerning the quality of feed, and access to finance, with central banks raising interest rates in order to combat inflation and lenders curtailing credit. Seafood and aquafeed producers will also continue to grapple with rising input prices, supply chain disruptions, and geopolitical troubles in 2023, Rabobank predicted.

This latest study echoes some of the findings in the “Global Animal Protein Outlook 2023,” published in December 2021, which projected that alongside chicken, the demand for farmed seafood – particularly salmon and shrimp – will continue to grow through 2023.

Overall, Rabobank has forecast a year-on-year animal protein supply growth of 1 percent or 5 million MT to a total of 430 million MT this year, following on from an expected production growth rate of 2 percent in 2022.

Photo courtesy of Rabobank