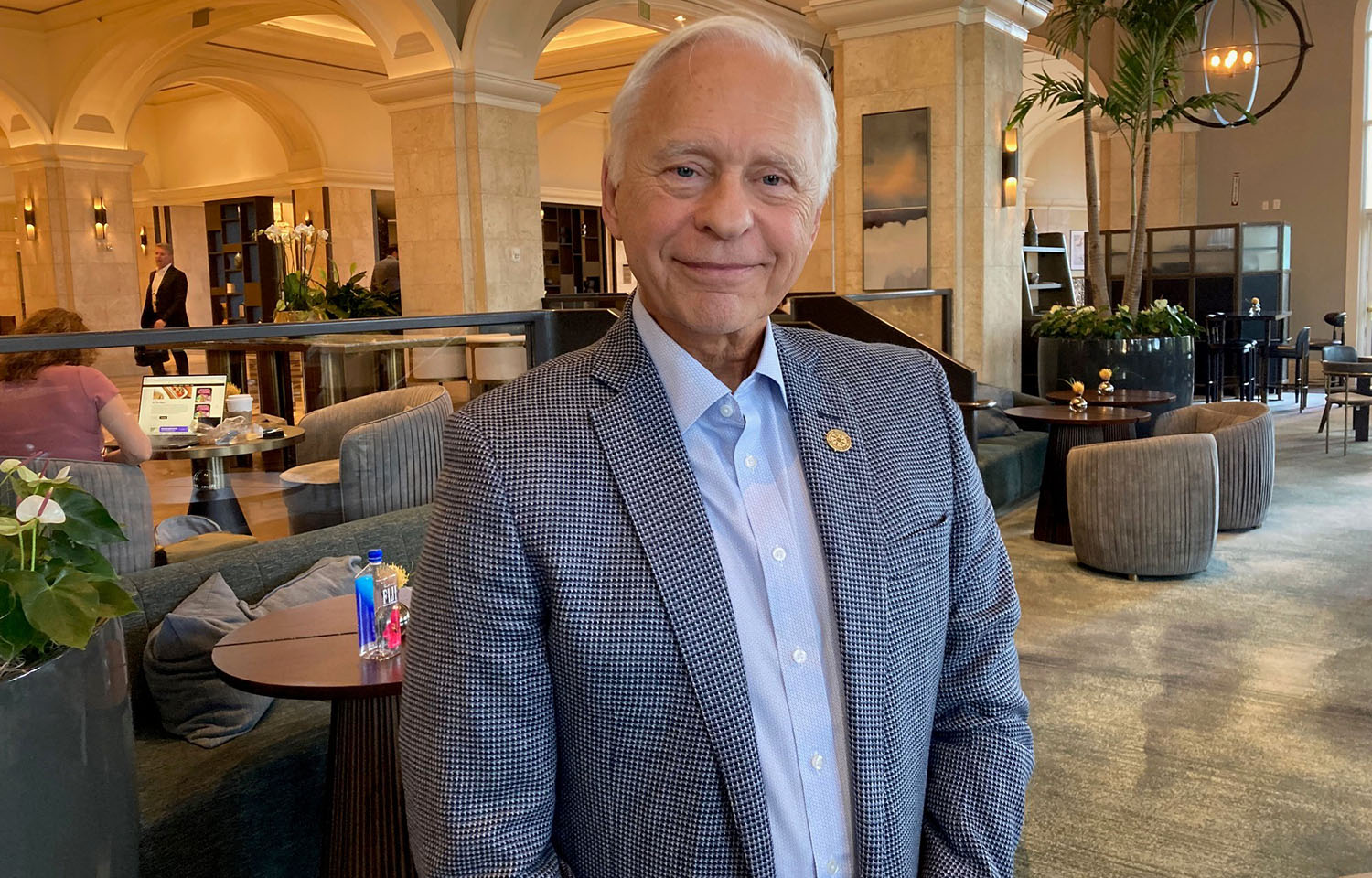

Jeff Davis is the former CEO of American Seafoods International, Baader North America, and Blue Harvest Fisheries. He also previously served as chairman of the National Fisheries Institute, as a board member for the Marine Stewardship Council and the New England Fisheries Development Foundation, as a member of the Saltonstall-Kennedy Task Force, and as a member of the board of advisors at the Center of Marine Research and Opportunity at Kingsborough Community College. He is still active in the seafood industry as the founder of International Seafood Partners (ISEA Partners).

SeafoodSource: How did you get your start in the seafood industry?

Davis: I'm from Acushnet; it is a small town outside New Bedford, Massachusetts, that’s best known as the home of the golf ball manufacturer Titleist, where both my parents worked. After getting out of the Marines, I worked briefly in the Titleist Rubber division while attending college. After graduating with a mechanical engineering degree, I wanted something different, so I tried my hand at the seafood business and found a home.

At that time in New Bedford, working on the waterfront was not considered the premier business to be in. However, I was fortunate to be hired at Tichon Seafood, one of the few vertically integrated U.S. seafood businesses. I quickly got an education in fishing, harvesting, filleting, freezing, and value-added production. I was hired to oversee their investment in mechanizing processing operations, which include many different Baader filleting machines for cod and flatfish. They also invested in a new plant, so I got involved with that project. While at Tichon, I gained exposure to the industry and learned a lot about fishing, processing, and markets. It was an excellent education and a great foundation; I learned something new every day.

From there, I went to Gloucester to work for O'Donnel Usen, where I learned a lot more about the value-added side of the business. While working there, Robert Reiser and Company out of Boston approached me to sell their food-processing machinery to the seafood industry. Working for Reiser was a very different direction but also an excellent opportunity to expand my knowledge of the industry, and it was also the first time I stepped into sales.

I began handling mincing and deboning equipment. Not long after starting with Reiser, they acquired part ownership in a small New York-based company that was the exclusive distributor for two European companies: Norway-based Stord Bartz, a manufacturer of equipment to cook, dewater, and dry proteins into meal, and Baader, a German developer and manufacture of fish-filleting machines.

I moved to New York to represent Reiser ownership, and we did pretty well; both lines of equipment grew substantially over the next few years. As the sales increased and the North American market became a more significant part of both European manufacturers' production, they recognized the importance of the U.S. market and the need for direct customer access. This was a common theme in the mid-1970s, as many European equipment manufacturers realized the importance of the U.S. market to their future and moved from using agents and distributors to direct representation by establishing sales subsidiaries in the U.S.

To U.S. distributors, the more successful they were, the faster this transition happened. In Reiser's case, our success prompted Stord Bartz and Baader to exercise their options to buy back the distribution agreements.

It was an unusual situation for me, as both companies offered me the position of president to start up and manage their North American subsidiary. It was a tough decision. I was deeply involved with the growth of both product lines; both were very successful, and both had an excellent opportunity to grow.

Baader was a worldwide powerhouse with a great reputation for its outstanding products and deep knowledge of fish processing. Stord Bartz was not as well-known but had a product line that could be used in many food-processing applications. Stord Bartz's business was on track to be a large company serving broad markets. However, my passion was the fishing industry with its heritage and the opportunity to work with a great company.

I could not resist Baader's offer to open and manage Baader North America Corporation for the Baader family. I have never been sorry for that decision. It led me to every corner of the world, working with great customers and colleagues. I have met some fantastic people in my journey throughout the seafood industry.

Fortunately, our Baader North America did very well and grew through the years. We introduced many new products into the market that allowed the growth of processing – probably none more important than the U.S. West Coast Alaskan pollock industry. At the time, we developed a fish-processing machine for Alaskan pollock. There was just one slight problem: No U.S. companies were catching or processing Alaskan pollock; it was considered a trash fish at the time. The small number of Alaskan pollock being harvested by U.S. vessels was sold over the side to Japanese and South Korean vessels.

No one in the U.S. wanted to buy or process Alaska pollock, so at Baader, we had this great machine called a Baader 182 that could cut, pin-bone, and skin 120 fish per minute, but we had no one to sell it to. So, we decided to rent a plant in Kodiak, Alaska, install the Baader 182s and all the other equipment we needed to make blocks and surimi, chartered a fishing boat, and set out to show the industry money could be made processing this trash fish called Alaskan pollock. We sold the product to Gorton’s, thanks to the help of an old friend, Jim Achert. In short, the plan worked. The rest is history.

SeafoodSource: How did you end up involved in American Seafoods?

Davis: It took a few years for the Alaskan pollock fishery to take off, and by 1987, the Alaska pollock fishing business was booming. Baader's business grew with the industry's success, but by the mid-90s, there was a gross overcapacity of fishing vessels in Alaska, and nobody was making money. Some brilliant guys recognized the need to rationalize the industry. The outcome was the American Fishery Act.

I had been with Baader for over 20 years and wanted to return to the fishing business. I had known Don Tyson for many years, and one day, while at Tyson's Springdale headquarters for a meeting with the COO, I got called into Don's office, and he told me they had decided to get out of the fishing business. It was a perfect opportunity, so I jumped on it and got Tyson to agree to give me a six-month exclusivity on the purchase.

With the exclusivity in hand, I began a search for partners and teamed up with [former American Seafoods CEO] Bernt Bodal, and we headed to Wall Street to find the big money we would need. Neither Bernt nor I had much experience with private equity; we were fish guys. We chose the wrong firm and, in the end, could not put a deal together. That was pretty disappointing, but it was one of many lessons learned in the world of deal-making. The Tyson deal would have been great, and it turned out to be just that for Trident. However, another lesson learned was that timing is everything.

About a year after the Tyson deal fell apart, I got a call from Bernt that American Seafoods had to be sold due to the passage of the American Fisheries Act (AFA) by Congress. Well, we went back to Wall Street, but most people we met did not buy the upside we saw coming with the new structure created by the AFA. However, this time, we found the right partner in Centre Partners, a small New York-based private equity firm.

Fortunately, Scott Perekslis at Centre Partners got it and convinced his partners at Centre to back us. It took about six months to get the deal done between the seller, Kjell Inge Rokke, and the new partnership comprising Centre, two CDQ groups, Bernt, and me, but it was worth the work.

Bernt and Scott had such amazing passion, so I never doubted we would get a deal done. Once we owned American Seafoods, growing the company was possible because we had good strategic and financial partners, a super team of high-performing, motivated people in management and staff, world-class crews, and great vessels and plants.

I stepped down as CEO at Baader North America but remained, and still do today, a member of its board of directors. Once we closed the American Seafoods deal, I took on the role of COO of American Seafoods Group and the CEO of American Seafoods International. In 2005, all the other partners in American Seafoods Group came together, and with the help of Glitner Bank, we were able to buy out Centre Partners Shares.

SeafoodSource: What is your take regarding American Seafoods' position now that it's for sale again?

Davis: American Seafoods Group is a great company and a fabulous cash-generating business. It has a tremendous ability to generate cash even in bad years. It can easily carry a four- to five-time trailing EBITDA debt. In my opinion, the company needs a capital structure where the annual interest cost is not more than USD 35 million to 40 million (EUR 32.2 million to 36.8 million). This will give operations room for cap-ex and give shareholders a healthy annual dividend or distribution.

American Seafoods needs ...