A new report from FAIRR, an investor network focused on environmental, social, and governance (ESG) issues in protein supply chains and the global food system, cautions investors to be wary of fed aquaculture, but recommends greater investment in shellfish farming.

FAIRR’s member network, who are responsible for managing USD 12.6 trillion (EUR 11.1 trillion) of assets and investments, includes such influential players as Aviva, DNB Asset Management and the Norwegian pension group KLP.

The report, “Shallow returns? ESG risks and opportunities in aquaculture,” identifies 10 ESG challenges that could hamper future growth of the USD 230 billion (EUR 201.9 billion) global aquaculture industry, while pointing out that it has averaged annual growth of almost 6 percent since 2000.

Innovations are also highlighted, along with investment opportunities in fish health, alternative feeds, repurposing waste as feed, and cultured seafood or plant-based replications of fish products.

Short-term risks are identified as disease, transparency and food fraud, effluents and antibiotic use. For example, the World Bank estimated in 2014 that disease costs the sector more than USD 6 billion (EUR 5.3 billion) per year in terms of mortalities, loss of stock, and prevention or treatments. In Chile, an outbreak of infectious anaemia (ISA) cost USD 2 billion (EUR 1.8 billion) and 20,000 jobs, and resulted in companies having to renegotiate loans with their banks. In Norway, it is estimated that salmon farms lose around 9 percent of revenues each harvest to costs associated with sea lice.

Transparency and food fraud is a major issue for the world’s most highly-traded food commodity. In particular, lower-value species may be passed off as higher-value fish. One study in Canada found that approximately 32 percent of fish sold in the country was mislabeled, and another found similar mislabeling rates in the U.S.

An increase in algal blooms is predicted by the report, in part linked to rising sea temperatures, but also to nutrient-rich effluents, which result from wastewater runoff. A major algal bloom in Norway in May and June of this year resulted in the loss of tens of thousands of tons of salmon, and a Nordea Bank analyst estimates that the losses reduce forecasted global supply growth from 6.6 percent to 5 percent.

On climate change, the report acknowledges that no reliable estimates of aquaculture’s contributions to greenhouse gas emissions exists, but cites a 2019 study that suggests freshwater aquaculture in the 21 top-producing countries may contribute 1.8 percent of global methane emissions. But the global warming to which the industry is a major contributor is also hurting the aquaculture sector; the study estimates marine fish production in Southeast Asia will decline by up to 30 percent by 2050 as a result of rising sea temperatures. And warming seas and changing salinity levels are also likely to result in increased incidences of salmon diseases and parasites.

Long-term risks are related to fish feed, labor conditions and fish welfare.

Antibiotic use is often unlicensed and its use is a major cause of shipments being stopped at the point of entry. A new Seafood Import Monitoring Program was introduced by the U.S. Food and Drug Administration in January 2019 that requires full traceability from the point of harvest. However, despite increased levels of in-country testing, 26 shipments of Indian shrimp were prevented from entering the U.S. during the same month. This is worrying for importers, as India accounts for 35.2 percent of all shrimp imports.

Medium-term risks are seen as community resistance, greenhouse gas emissions, habitat destruction, and biodiversity loss.

Increasing pressure from concerned groups and businesses may impede aquaculture companies from developing their farms in coastal waters. For example, in 2018, Washington’s state senate voted to phase out non-native fish aquaculture across the entire state by 2025, after local communities protested against a large farmed salmon escape and the industry’s impact on biodiversity.

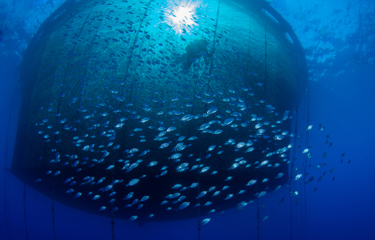

Farmed fish escapees are identified as a potential cause of harmful impacts to their wild counterparts, as well as a direct financial loss to farmers. According to the report, in 77 out of 147 rivers sampled in Norway researchers found wild salmon impacted by farmed salmon genes. Mowi is cited as losing 690,000 salmon worth USD 3.4 million (EUR 3 million) in July 2018 when a storm severely damaged 10 net pens. The report notes companies are making significant investments to prevent farmed fish from escaping, but says more work is needed.

In regard to the fishmeal and fish oil sector, demand is predicted to outstrip supply and constrain future growth of the sector. In 2016, around one-fifth of the world’s commercially-caught fish was used for fishmeal and fish oil production, and the pressure is on to find a wider basket of non-marine raw materials that deliver the same benefits to fish and human health. Feed currently accounts for between 30 to 70 percent of production costs and the report predicts that the price of fishmeal and fish oil will rise by 90 percent and 70 percent, respectively, to 2030.

In Asia, the seafood supply chain has long been associated with labor and human rights issues and mistreatment of migrant workers, leading to consumer concerns. As a result, countries have been issued yellow cards from the European Commission and threatened with a ban on their seafood imports, which has encouraged them to make efforts to address the issue. Legislation such as Modern Slavery Acts in the United Kingdom and Australia, and the Transparency in Supply Chains Act in the U.S. state of California, are helping, but progress remains slow.

On fish welfare, the report points to a separate study that linked higher welfare standards to better financial performance amongst aquaculture companies, suggesting that those who paid greater attention to fish health were better at mitigating overall risks.

FAIRR Director Maria Lettini advised the aquaculture sector to address its significant environmental and public health challenges, and to obtain certification against a global standard if it is to prosper in the long-term.

“The market should also consider greater cultivation of species that remove marine pollution rather than contribute to it, such as mussels and oysters," she said. "Farming these species brings minimal animal welfare concerns and does not require fishmeal-based feed.”